Date Set for Warrant Article Event

The Nottingham Blog warrant article event will be held on Tuesday, December 10, from 5:00 to 7:30 p.m. at the Nottingham Community Church. This is a by-donation event. Donations will go to the Nottingham Community Church to help maintain their building.

Three warrant articles have been proposed so far. If you’d like to see any of these warrant articles make it to the ballot, drop by the event to sign it.

There’s still plenty of time to submit ideas for warrant articles. If you have an idea, contact me. See this prior article for more details.

Here are the three warrant articles that have been proposed so far.

Enhancement to the tax exemption for the disabled

This warrant article increases the tax exemption for the disabled by approximately 20%, and increases the income for qualifying for the exemption by approximately 20%.

Shall the town modify the provisions of RSA 72:37-b, Exemption for the Disabled from property tax, based on assessed value for qualified taxpayers to be $121,000. To qualify the person must have been a New Hampshire resident for at least 5 years, own the real estate individually or jointly, or if the real estate is owned by such person's spouse, they must have been married for at least 5 consecutive years. In addition the taxpayer must have a net income of not more than $46,000 or if married, a combined net income of not more than $58,000, and own net assets not in excess of $245,000 excluding the value of the person's residence.

Sponsor: Angela Pratt

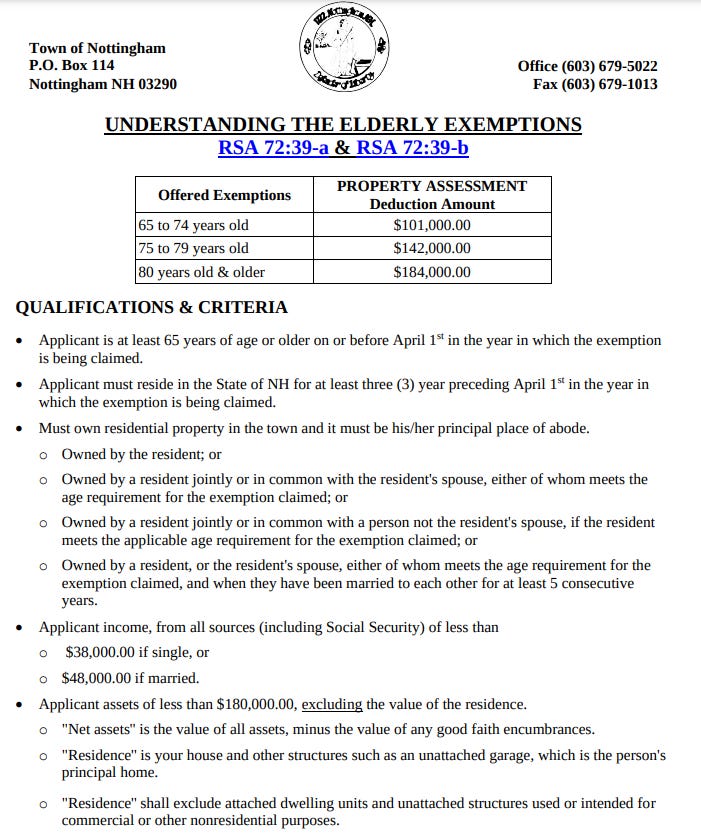

Enhancement to the tax exemption for the elderly

This warrant article increases the tax exemption for the elderly by approximately 20%, and increases the income for qualifying for the exemption by approximately 20%.

Shall the town modify the provisions of RSA 72:39-a for elderly exemption from property tax in the Town of Nottingham, based on assessed value, for qualified taxpayers, to be as follows: for a person 65 years of age up to 75 years, $121,000; for a person 75 years of age up to 80 years,$170,000; for a person 80 years of age or older $220,000. To qualify, the person must have been a New Hampshire resident for at least 3 consecutive years, own the real estate individually or jointly, or if the real estate is owned by such person's spouse, they must have been married to each other for at least 5 consecutive years. In addition, the taxpayer must have a net income of not more than $46,000 or, if married, a combined net income of less than $58,000; and own net assets not in excess of $245,000 excluding the value of the person's residence.

Sponsor: Angela Pratt

To establish a fund for swimming lessons

To see if the town wishes to establish a $10,000 fund for providing swimming lessons during summers at town beach. The fund is to be managed by the Recreation Department, which will be authorized to charge fees for these lessons. Income from these fees will be used to offset expenditures from the swimming lesson fund.

Sponsor: Dan Davis